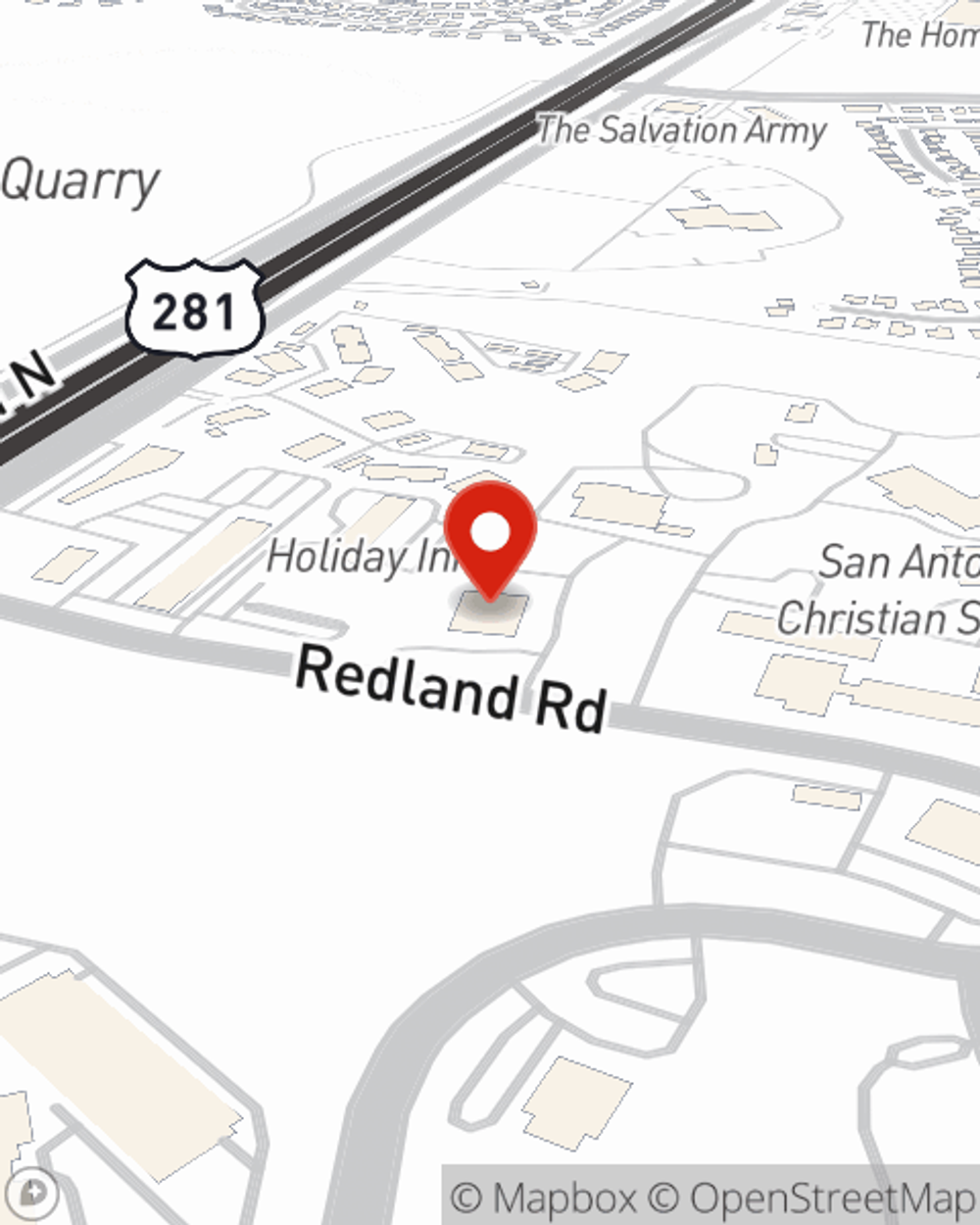

Life Insurance in and around San Antonio

Get insured for what matters to you

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- Boerne

- Bulverde

- Spring Branch

- New Braunfels

- Helotes

- Stone Oak

- North San Antonio

- Cibolo

- Comfort

- Kerrville

- Fredericksburg

Your Life Insurance Search Is Over

People decide to get life insurance for various reasons, but the ultimate goal is many times the same: to ensure the financial future for the ones you hold dear after you perish.

Get insured for what matters to you

Now is a good time to think about Life insurance

Their Future Is Safe With State Farm

When deciding on your Life insurance coverage, it's helpful to know the factors that play into the type and amount of Life insurance you need. These tend to be things like how old you are, your physical health, and perhaps even lifestyle and occupation. With State Farm agent Alex Post, you can be sure to get personalized service depending on your individual situation and needs.

To check out State Farm's Life insurance options, contact Alex Post's office today!

Have More Questions About Life Insurance?

Call Alex at (210) 920-2642 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.